Giới ThiệuChúng tôi là sự lựa chọn

tốt nhất dành cho bạn !

Những sản phẩm, dịch vụ và giải pháp tốt nhất trong ngành hoá chất với giá cả siêu hợp lý.

Để lại thông tin chúng tôi sẽ gọi lại cho bạn

Dịch vụNhững dịch vụ tốt nhất

của chúng tôi

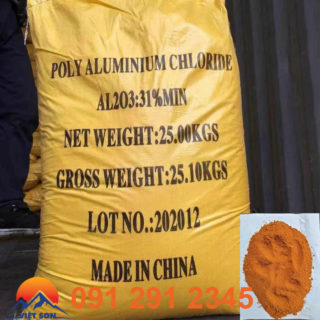

Hoá chất công nghiệp

Các hoá chất trong nghành Công nghiệp chủ chốt như ngành Keo, Khai Khoáng, Dệt Nhuộm, Xi mạ, Môi Trường, Xử lý Nước.

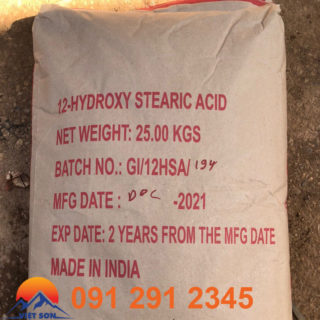

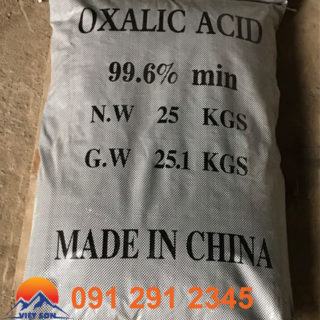

Hoá Chất Cơ Bản

Các hoá chất thông dụng dùng trong rất nhiều ngành nghề, các lĩnh vực để sản xuất ra các hoá chất, sản phẩm.

Hoá chất nuôi trồng Thuỷ Hải Sản

Các hoá chất bổ xung vi chất, cải tạo, trị bệnh trong ngành Thuỷ Hải Sản.

Hoá chất Tẩy rửa

Các hoá chất tẩy rửa, rác thải công nghiệp, vệ sinh làm sạch, khử trùng.

Bảo dưỡng TB trao đổi nhiệt

Bảo trì, sửa chữa, tẩy rửa thiết bị trao đổi nhiệt như vệ sinh, tẩy rửa nồi hơi, các thiết bị trao đổi nhiệt trong các nhà máy sản xuất.

100%Khách HÀi Lòng

2000+Khách Mỗi Năm

20 +Năm Kinh Nghiệm

150+Sản phẩm sẵn có

hoachatvietson@gmail.com

hoachatvietson@gmail.com Hotline:

Hotline:  Thời gian làm việc: 07:30 - 22:00

Thời gian làm việc: 07:30 - 22:00

Vietnamese

Vietnamese